There are many reasons why a diverse range of professionals — project scientists and engineers, managers & C-level executives, BD teams, lawyers, academics and government policy makers — may want to engage a microfluidics or analytical chemistry consultant. Here below are some examples of project types and routine consulting work we do to meet our clients’ needs.

Product Development

- optimising product’s analytical chemistry on the benchtop prior to microfluidic translation

- researching existing design approaches and appropriate device materials in published literature, website & patent material

- proof-of-principle testing of key analysis steps using off-the-shelf microfluidic and instrument components, where possible

- early stage prototype design/build/test iterations of your microfluidic device

- conceptual and CAD design of prototype

- sourcing appropriate fabrication house for prototyping & transfer to manufacturing

- designing experiments to evaluate prototype performance; trouble-shooting experiments

- interpreting results, using performance gaps as input for next design iteration

- later stage alpha & beta prototyping

- design reviews and small iterations for performance enhancements & volume manufacturing

- sourcing/changing to appropriate fabrication house for volume manufacturing

- quality management system (QMS) considerations

- corporate ISO 9001 quality system design

- product-specific quality plan, including GMP, ISO 13485 and/or others, as appropriate, for client and vendor(s)

- launched product

- trouble-shooting manufacturing and/or QMS issues; implementing revisions

- trouble-shooting failure modes

Corporate Investment Due Diligence

- deep dive into target company’s technology

- review publications, reports, presentations, raw data

- dialogue with technology leads at company regarding areas of interest/concern

- review of company’s & competitors’ IP

- determine scope of company’s claims, proximity of competitors’ in same/similar technology area

- consider merits of competing technologies in different technology areas for same application

- on-site visit

- see technology and processes first-hand

- discuss strengths & issues of technology and value proposition directly with company leadership

- form impression on strength of leadership team

Intellectual Property (IP) Research

- mapping out a competitive IP landscape to highlight product development and/or licencing opportunities

- looking at a company’s or institution’s own IP disclosures or patent estate to assess context and value, as well as possible outside sales or infringement litigation opportunities

- examination of a competitor’s patent suite in a given technology or product area to identify likely upcoming products, their strengths & weaknesses

- subject matter expert for litigation, validity, etc.

Business Development

- content creation:

- generating, updating or proofing copy for webpages, brochures/e-books/whitepapers, info/spec sheets, blogs etc.

- generating social media posts to convey your company’s leadership role in relevant technology, application or market sectors

- research:

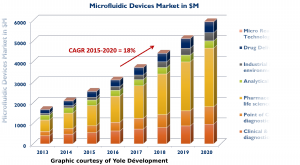

- mapping out a competitive technology landscape to highlight companies and technologies currently serving a product or application area

- identifying capabilities, infrastructure, network members etc. in a technology sector within a geographic area (for e.g. technology associations, government agencies, etc.)

Please email us for more information.